Get in touch with us before February 23, and we’ll prepare the Delaware Franchise Tax filing for you, completely for free. Whether you’re a startup or a growing business, Mosey offers the tools and insights to navigate Delaware’s regulatory landscape efficiently. If you need to take care of this mandatory obligation, then Harvard Business Services, Inc. can help you get this done. The fastest and easiest way to proceed is by paying the Franchise Tax online on our website. To get the specific calculations for your business, visit the Division of Corporations website and follow the instructions provided. And for every extra set of 10,000 shares (or any part of that), tack on another $85.

How do I pay my franchise taxes and file the annual report?

The Annual Franchise Tax assessment is based on the authorized shares. The total tax will never be less than $175.00, or more than $200,000.00. Moreover, the Delaware Franchise Tax Calculator is designed to be user-friendly, allowing businesses to effortlessly https://www.intuit-payroll.org/ determine their annual tax liabilities. However, it is essential to remember that the calculator is merely a tool, and the actual tax owed may vary slightly. The Assumed Par Value Capital Method sets the minimum tax at $400, with the maximum at $200,000.

When are franchise taxes due for my Delaware corporation?

Certain exempt domestic corporations like charities, civic organizations and religious organizations do not have to pay the franchise tax. However, they must still file an annual report and pay the filing fee. In order to utilize this filing method, you will need to provide the company’s total gross assets (as reported on Form 1120, Schedule L) and the total number of issued shares. The tax is then often calculated to the minimum payment of $400 tax plus the $50 annual report fee, for a total of $450 due per year. Delaware domestic corporations must file a fully completed annual report and pay both the annual report filing fee and franchise tax by Tuesday, March 1st, 2022. The Franchise Tax Department will be available to assist on Saturday, February 26th, by email and chat from 8 am to 4 pm.

Special Considerations for Specific Entities

- This document certifies the date the company was formed, that the company is current, and that the company is in good standing.

- This franchise tax fee varies depending on the chosen calculation method — the Authorized Shares Method or the Assumed Par Value Capital Method.

- No tax for you, but you still need to turn in that report by March 1.

- This emphasizes the importance of adhering to the given deadline to avoid accumulating penalties and additional financial burdens.

- The Delaware franchise tax for a corporation is slightly more complicated.

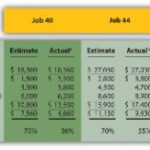

The annual report fee is $50 and the tax would be somewhere between $200 and $200,000 per year, as illustrated below. The Delaware Franchise Tax for a corporation is based on your corporation type and the number of authorized shares your company has. The total cost of the corporation’s Delaware Franchise Tax consists of an annual report fee and the actual tax due. Non-stock or non-profit companies are considered exempt from tax in Delaware. As with the franchise tax, registered agents are vital cogs in annual report compliance.

Authorized Shares Method

If a corporation has 5,000 shares or less, it pays the minimum tax of $175. For corporations with over 10,000 shares, the tax is $250 plus $85 for each additional 10,000 shares (or portion thereof) to a max annual tax of $200,000. Failing to pay your franchise tax by March 1st for corporations or June 1st for LLCs will result in a late penalty and interest. After missing the deadline, you’ll need to pay a $200 late fee with cumulative interest each month. Paying a franchise tax is a legal requirement for business incorporated in the state of Delaware.

Who needs to pay the Delaware Franchise Tax?

The Annual Report fee for this process is $50, and it should be submitted along with your State Franchise Tax payment. Read our article for more information on how to file business taxes for an LLC. In 2022, Delaware saw 73.7% of its business entity formations, amounting to 231,196, register as LLCs, underscoring the state’s role as a pivotal business hub [2]. The annual due date of Delaware LLC taxes is March 1st each year [1]. All LLCs registered in Delaware are subject to the Delaware Franchise Tax.

Failure to pay the annual franchise tax can result, in penalties, fines, or even the loss of right to conduct lawful business. When you submit your Delaware franchise tax payment, you’ll also need to submit an annual report. Often, the tax is then calculated to the minimum payment of $350, with a $50 annual report fee. If you don’t want to pay your Delaware franchise tax yourself, you can hire a registered agent to do it for you. The registered agent will charge a small fee to complete the filing of your Delaware franchise tax.

It is important to note that Delaware will not issue Good Standing Certificates for corporations that have not met the annual report filing requirements. All non-exempt non-stock corporations pay a franchise tax of $175. The Delaware corporation annual report must be signed by the corporation’s president, secretary, treasurer, or other duly authorized officer or by any of its directors. If filing an initial report, any incorporator can be an authorized signer in the event the board of directors has not yet been elected. Keep in mind that incorporators may not sign subsequent annual reports.

Chandler said, “The corporate market isn’t ‘feeling good’ about Delaware,” and questioned McCormick and Laster’s objectivity on cases related to the bill’s amendments to state law. House sponsor Krista Griffith (D-Fairfax) said the amendments are necessary to protect Delaware’s place as the top destination for businesses to incorporate. The bill has garnered significant opposition from the legal community in Delaware and across the country, including the top judge of the state’s powerful Chancery Court. Under the proposal, a Delaware company could make a side agreement with a single shareholder without a full vote of the board of directors. That deal could turn over the company’s control to that powerful individual and permanently deprive the board of its decision-making authority. In an April letter to the Delaware State Bar Executive Committee, Chancellor Kathaleen McCormick, head of the Court of Chancery, wrote she feels the process is moving too quickly amid the ongoing court case.

The process might look intimidating, but it’s actually very straightforward, and we’ll walk you through the trickiest parts. Sign up now or schedule a free consultation to see how Mosey transforms business compliance. Once we have received your online order, we will submit the https://www.quick-bookkeeping.net/politico-analysis/ filing to the state of Delaware. You will receive an email copy of the documentation for your records. A corporation with 100,000 shares authorized pays $1,015.00($250.00 plus $765.00[$85.00 x 9]). A corporation with 10,005 shares authorized pays $335.00($250.00 plus $85.00).

In addition to corporations, Delaware limited liability companies (LLCs), general partnerships, limited partnerships (LPs) and limited liability partnerships (LLPs) must also pay franchise taxes. You are still required to file the Delaware annual 4 ways to calculate depreciation on fixed assets report and pay the Delaware corporation tax (franchise tax) even if the corporation never engaged in business. Note that only one Delaware annual report is required to be filed by March 1st, even for corporations paying quarterly franchise taxes.

An annual Franchise Tax Notification is mailed directly to the corporation’s registered agent. The Delaware Division of Corporations will require all Annual Franchise Tax Reports and alternative entity taxes to be filed electronically. The bill’s prime House sponsor, State Rep. Krista Griffith (D-Fairfax), notes corporate franchise taxes make up around a third of Delaware’s revenues, and the industry as a whole makes up close to half. This one calculates the tax based on the corporation’s gross asset total and issued shares. This method often favors corporations with a high number of shares but lower asset values. The Delaware annual report includes information about the registered agent, principal business location, directors, and officers, ensuring transparency and up-to-date records with the state.

Corporations that do not file a Delaware annual report by March 1st are assessed a $200 penalty plus interest at 1.5% per month applied to any unpaid tax balance, in addition to the original tax and annual report fee. A corporation may pay its franchise taxes directly via Delaware SOS ACH. Owners of multiple corporations will need to pay Delaware Franchise Tax for each entity separately as each entity is required to file an annual report. Understanding and adhering to Delaware’s franchise tax and annual report requirements is important for any business incorporated in the state.

But the Moelis decision is expected to be appealed to the Delaware Supreme Court, and State Rep. Madinah Wilson-Anton (D-Newark) argues time should be given to the justice system to properly litigate. But this year’s bill is particularly contentious due to an amendment that would allow a company to make agreements with stockholders without the full approval from its board of directors. If you don’t have a tax preparer, don’t wait until the last minute!