Accountant consultants are well-versed in deciphering financial data to assess a company’s financial health. An accountant consultant’s role varies depending on their area of specialization and their clients’ specific needs. The path to becoming an accountant consultant involves an interplay of formal education, professional certifications, and substantial hands-on experience. Accounting consultants must stay ahead of these changes to provide their clients the most current and effective solutions. They guide businesses in adopting state-of-the-art software and technology, which can enhance operational efficiency and accuracy in financial matters.

Explore accounting consultant education requirements

For 30 years, the Deloitte Technology Fast 500 has recognized the fastest-growing technology companies in North America. However, the cons include intense work pressure, long working hours, and the need for constant skill upgrading. Their work in this area might involve detailed evaluations of financial statements, identifying risks, detecting inefficiencies, and assessing overall financial performance.

Navigating a Complex Compliance Landscape

The role of an accounting consultant may vary depending on the client’s needs. Still, it typically involves analyzing financial statements, developing budgets, providing tax advice, and assisting with financial decision-making. Also, ensure that your résumé contains adequate detail about your previous employers. “The biggest mistake high-level accounting people make on their résumés is that they don’t let the reader know the type of industry the company is, the size of the company,” Plato said.

Strategic Planning and Advice

That is why, when it comes to fees, you will find our accounting company are completely transparent. Nevertheless, these data are truly useful to management and investors of the company in case of their relevance, objectivity and completeness of the indicators reflect business activity. Consultants should be proficient in the skills their prospective employer https://www.business-accounting.net/ needs and be able to quickly adapt to the processes and procedures of their new workplace. When working as an independent consultant, however, you may enjoy more freedom to choose your clients and the hours you work (see “From Controller to Consultant”). You can work out any problems or issues with your client directly without involving a third party.

Marcum’s Tax & Business Services Group provides a comprehensive offering of tax advisory and regulatory compliance services as well as specialization in a variety of areas. With Practice Forward content, tools and guidance, you can expand into advisory services, improve margins, drive growth, and elevate client service. Discover how to grow your accounting practice and become a next generation firm through high value advisory services with Practice Forward. Traditionally, the nature of accountancy means that you collect historical information and data and report on it.

Essential Skills for Success in Accountant Consultancy

Accounting consultants, on the other hand, don’t work on these operational tasks. Instead, they provide value through teaching, guiding, and advising their clients based on their observations of how they manage their finances and teams. This can mean creating operational efficiencies in their processes, recommending software or systems, or instituting best practices and frameworks to spot red flags before they become bigger issues. Once they understand the client’s requirements, the accounting consultant will conduct an exhaustive financial analysis, examining the company’s revenue, expenses, cash flow, and other key financial metrics.

A career in our Financial Accounting practice, within Tax services, will provide you with the opportunity to help our clients meet and manage their tax obligations across unique but ever changing tax specialties. You’ll advise clients on their local and overseas tax affairs, while acting as a strategic consultant related to business analysis, managing indirect taxes, dispute resolution, and global enterprise tax solutions. The top Accounting consulting firms in the US list presents the country’s leading consultancy firms in the industry, based on our unique database of more than 2 million data points spanning insights from clients and consultants.

Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. Getting started can be as simple as merely getting your name out there to your existing clients and referral sources or as complicated as starting a business from the ground up. Let’s examine the definition of accounting consulting and describe exactly what accounting consultants do, how to become an accounting consultant, why you should consider making the switch, and much more. Professional certifications such as CPA and CMA showcase expertise and commitment.

- Marcum LLP is a national accounting and advisory services firm dedicated to helping entrepreneurial, middle-market companies and high net worth individuals achieve their goals.

- You’ll advise clients on their local and overseas tax affairs, while acting as a strategic consultant related to business analysis, managing indirect taxes, dispute resolution, and global enterprise tax solutions.

- Accounting consultants are vital in helping businesses manage their finances, comply with regulations, and make strategic financial decisions.

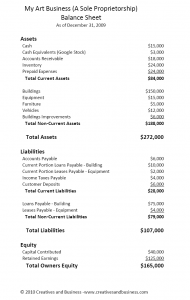

These individuals hold an in-depth understanding of accounting principles and how to apply them in various business scenarios. These professionals ensure smooth financial operations, regulatory compliance, and strategic financial planning. useful advice on how to make a balance sheets often grapple with the complexities and constant changes in financial regulations. Staying abreast of these changes and ensuring that businesses adhere to them can take time and effort.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. Businesses should consider the consultant’s qualifications and experience when choosing an accounting consultant. The effectiveness of an accounting consultant can also be influenced by their fit with the business’s culture and operational style. This often involves extensive discussions with the client and a thorough review of the company’s financial records and business practices.

If communication channels are not clear and compelling, it could lead to misunderstandings and inefficiencies. The results of this analysis are often presented to the client in the form of detailed financial reports. Visit our Global IFRS technical resources for insights and resources to help with the International Financial Reporting Standards (IFRS). The Better Finance podcast explores the changing dynamics of the business world and what it means for finance leaders of today and tomorrow. AI will be a vital tool in the next generation of company key performance indicators involving trust, culture and ESG risks. Finance teams can learn from the experience of their peers who have already filed 2020 accounts during the pandemic.

Additionally, they guide businesses in preparing for external audits by conducting pre-audit checks and updating financial records as required. This activity includes adherence to tax laws, financial reporting standards, and other relevant legislation. An https://www.accountingcoaching.online/why-isn-t-land-depreciated/, equipped with a deep understanding of a business’s unique needs, can develop an effective accounting system. These insights enable organizations to make informed decisions and bolster their financial health.